The global finance sector is entering a period of stabilization and growth following years of volatility. This comprehensive finance outlook for 2026 covers stock market trends, banking growth, digital payments, gold price movements, and real estate investments.

1. Stock Markets Show Renewed Momentum

Global equity markets are gaining strength due to favorable economic data, increased investment activity, and improved corporate earnings.

1.1 Rise of Emerging Market Stocks

Countries like India, Brazil, and Vietnam are attracting foreign investment due to strong economic fundamentals.

1.2 Tech Stocks Lead Global Rally

AI, robotics, semiconductor manufacturing, and cybersecurity companies are seeing strong investor demand.

2. Banking Sector Reports Strong Loan Demand

Banks are experiencing increased demand for retail and business loans due to stable interest rates and positive consumer sentiment.

2.1 Home Loans Rise Significantly

Real estate affordability and favorable mortgage rates are driving housing loan demand.

2.2 Growth in Business Lending

Small and medium enterprises (SMEs) are taking loans to expand operations, buy equipment, and hire employees.

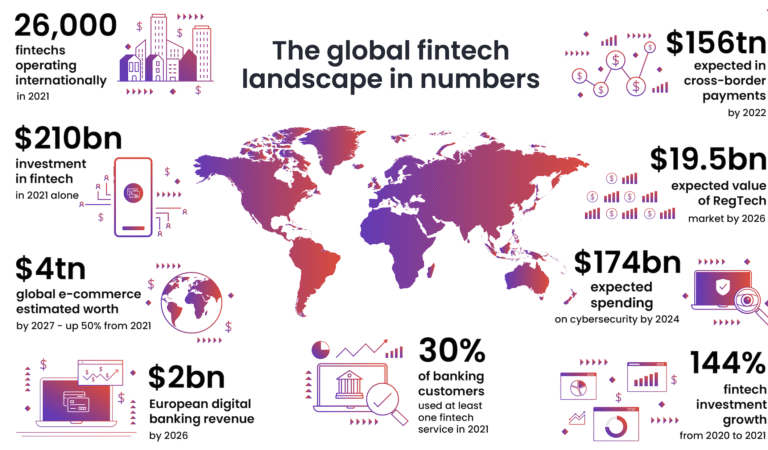

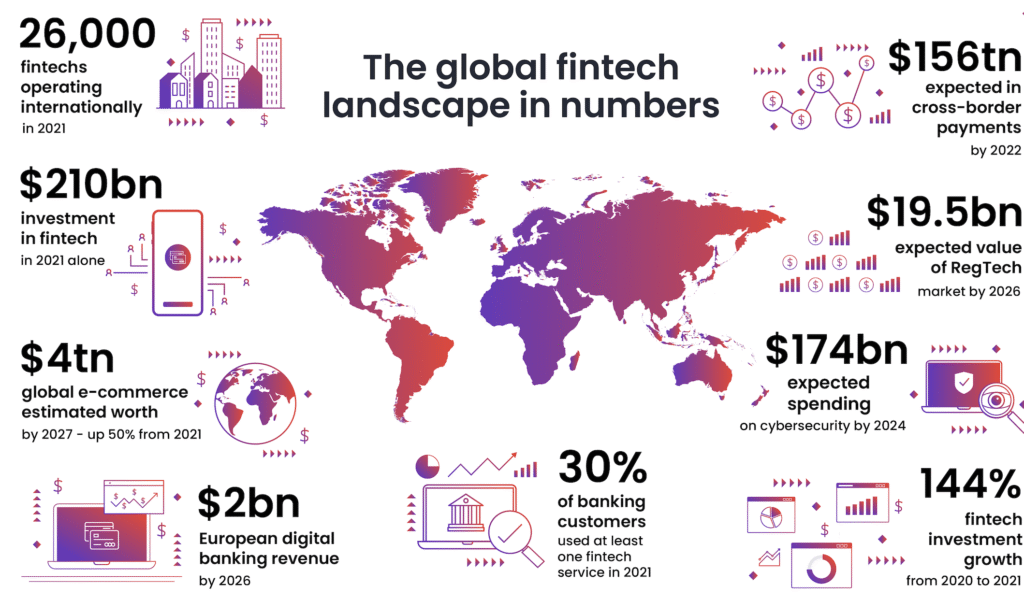

3. Fintech Expansion Redefines Global Finance

Fintech companies are transforming financial systems with instant payments, digital wallets, micro-investments, and AI-based risk analysis.

3.1 Rise of Digital Payment Systems

Consumers are switching to faster, more secure payment platforms and online banking systems.

3.2 Crypto & Digital Currencies

Central bank digital currencies (CBDCs) are entering public use in many countries, improving financial transparency.

4. Gold Prices Show Volatility Amid Global Uncertainty

Gold remains the world’s favorite safe-haven asset. Prices fluctuate based on economic uncertainty, currency swings, and inflation trends.

4.1 Investor Preference for Gold ETFs

Exchange-traded gold funds are becoming more popular among retail investors seeking stable returns.

4.2 Physical Gold Demand

Demand for jewelry and investment-grade gold bars remains high in Asia and the Middle East.

5. Real Estate Investment Continues to Grow

Real estate remains a top investment choice for global investors due to rental income stability and long-term value.

5.1 Commercial Real Estate Growth

Warehouses, office buildings, and logistics hubs are seeing increased demand from corporations.

5.2 Residential Market Demand

Urban housing development is rising in major cities due to rapid population growth.

Conclusion

The finance landscape of 2026 is shaped by stable markets, digital transformation, and increasing real estate demand. Investors are focusing on diversified portfolios, long-term assets, and technology-driven financial tools.