After several quarters of caution due to global economic uncertainties, the Indian startup ecosystem is witnessing renewed activity, particularly in growth-stage funding. Investor appetite had softened earlier in the year due to inflationary pressures in the U.S., fluctuating interest rates, and valuation corrections. However, improved macroeconomic stability and policy clarity have revived confidence among venture capital firms and private equity investors.

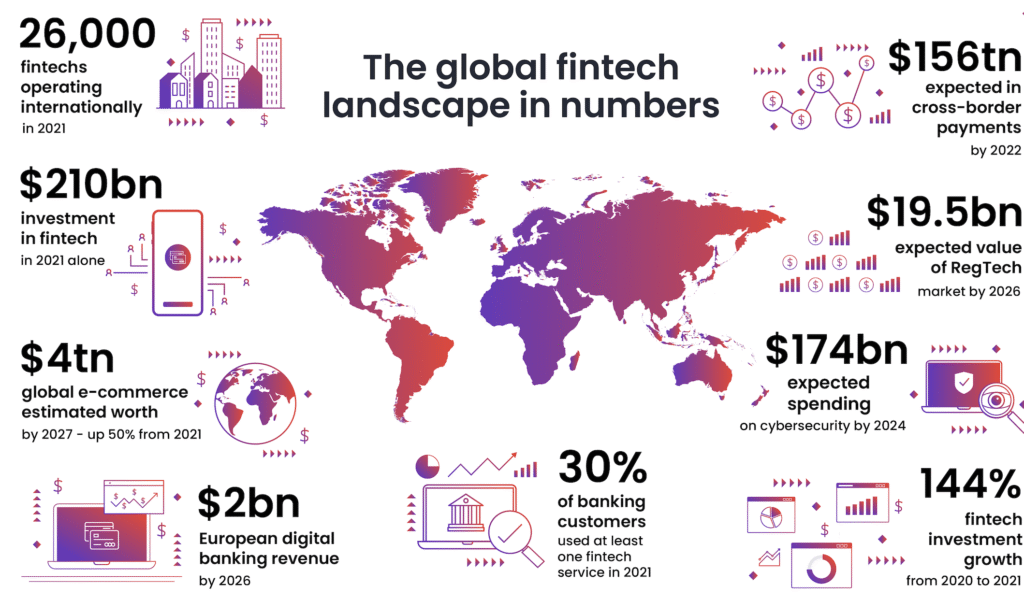

Fintech startups are regaining momentum as digital payments continue to expand rapidly across India’s retail and financial ecosystem. Meanwhile, the health-tech sector remains strong due to increased demand for telemedicine, AI-based diagnostics, and hospital automation tools. AI-led enterprise solutions, especially those focused on workflow automation, cybersecurity, and analytics, are attracting significant investment from global funds.

One of the biggest shifts observed is the increasing investor emphasis on profitability and sustainable growth over rapid expansion. Unlike the funding boom years of 2020–2022, investors today are more selective, favoring companies with proven revenue streams, strong unit economics, and long-term viability. However, this stricter approach has not dampened overall investment potential. Many experts believe India is entering a new phase of “quality-driven growth,” which will lead to healthier valuations and more resilient startups.

With global liquidity conditions expected to improve by early 2026, analysts anticipate a further resurgence in both late-stage and pre-IPO funding rounds. India’s vibrant consumer market, digital infrastructure, and pool of engineering talent are likely to sustain this upward trajectory.